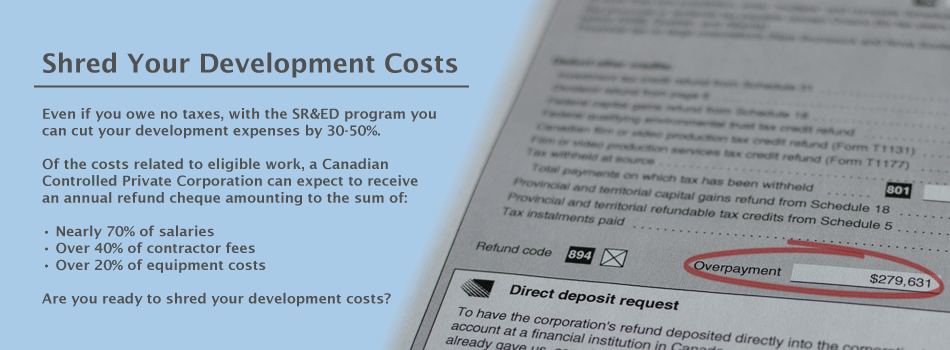

Shred Your Development Costs

Even if you owe no taxes, with the SR&ED Program, you can cut your development expenses by 30-50%. Of the costs related to eligible work, a Canadian Controlled Private Corporation can expect to receive an annual refund cheque amounting to the sum of:

- Nearly 70% of salaries

- Over 40% of contractor fees

- Over 20% of equipment costs

Canada provides over $4 Billion per year in incentives to keep foreign and domestic businesses working in Canada. Nearly every company which performs development or manufacturing qualifies for significant annual tax credits. For most corporations those credits are refunded in cash.

Many companies underestimate their eligibility, mistakenly assume that their tax situation does not qualify for a cash refund, or worry that the filing process is too daunting to be worthwhile. These companies have fallen prey to common SR&ED Myths and are missing out on a reliable annual revenue stream.

With The Resonant Advantage, the process is simple; our SR&ED experts do all the work. The first claim usually requires only a handful of hours on the part of the client. Subsequent claims are even further streamlined, so that your SR&ED refund seems almost to surprise you every year. As a bonus, first-time filers can retroactively claim for the previous year (don’t miss the deadline!). Very likely there are two cheques waiting for you to claim.

What about the risk? Even the most risk-averse see SR&ED as a sure-thing. There is no approval process, the funds do not run out. Your annual refund is guaranteed for as long as you do the eligible work. Major financial institutions will even lend against the SR&ED credits accrued mid-year. Finally, Resonant’s fees are entirely contingent upon your successful claim. With a 100% filing success rate, we are confident in your successful claim, and defer our percentage-based fee until after you receive your refund cheque.

Contact us today to access the funds you have already earned!